excise tax rate nc

Excise Tax on Conveyances. The transferor must pay the tax to the register of deeds of.

Equity Of Health Financing In Indonesia A 5 Year Financing Incidence Analysis 2015 2019 The Lancet Regional Health Western Pacific

IFTA Annual Interest Rates Motor Carrier Seminars.

. Federal excise tax rates on beer wine and liquor are as follows. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Read this memo for all the.

For example a 600 transfer tax would be imposed on the sale of a 300000 home. Cigars and Cigarettes. Easily calculate the North Carolina title insurance rates and North Carolina property transfer tax.

Chapter 105 - Article 8E. EXCISE TAX ON CONVEYANCES Article 8E - Title Change. As it turns out if you win more than 1250 on the slots your federal excise tax bill will be 025 percent of the total winnings in addition to any tax bill the state tax collector will assess.

Excise Tax on Coal. IFTA Annual Interest Rates Motor Carrier Seminars Business Income Tax Seminars. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 75.

107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content. So if you purchase a home or land for 900000 the revenue tax would be 900000 divided by 1000 and multiplied by 2 which equals 1800. A proof gallon is a gallon of liquid that is 100 proof or 50 alcohol.

The title of the Article Excise Stamp on Conveyances was changed to replace the word. This Article applies to every person conveying an interest in real estate located in North Carolina other than a governmental unit or an instrumentality of a governmental unit. The controlling statute GS.

2020-91 and North Carolina General Statute Section 105-44980 the Secretary of Revenue has determined that the motor fuels and alternative fuels tax rate for the period of January 1 2022 through December 31 2022 will be 385 cents per gallon or gallon equivalent. Have you ever wondered how to calculate the revenue stamps excise tax on the sale of real estate in North Carolina. Transfer taxes in North Carolina are typically paid by the seller.

The tax rate is one dollar 100 on each five hundred dollars 50000 or fractional part thereof of the consideration or value of the interest conveyed. In addition to the road tax every gallon of motor fuel includes a 0025 cents per gallon inspection tax. Excise Tax on Conveyances.

The City of Kannapolis 063 and Cabarrus County 074 combined tax rates for 2020 are 137. Current North Carolina Tobacco Excise Tax Rates. North Carolina has 1012 special sales tax.

The excise tax is deposited in the Black Lung Disability Trust Fund. When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 is levied on the value of the property. 5033 per 1000 cigarettes or.

Individual income tax refund inquiries. The North Carolina use tax should be paid for items bought tax. Dec 15 2021.

Customarily called excise tax or revenue stamps. Excise Tax Technical Bulletins. North Carolina Title Insurance Rate Excise Tax Calculator.

Kerosene Used in Aviation - Form 720 Tax Liability Reporting. Federal excise tax rates on tobacco products are as follows. How To Calculate Excise Tax In Nc.

125000 assessed value x 137 tax rate100 171250. This title insurance calculator will also estimate the NC land transfer tax where applicable This calculator is designed to estimate. The tax is adjusted depending on the.

This is assessed per hundred dollars of assessed value. IFTA Annual Interest Rates Motor Carrier Seminars Business Income Tax Seminars Power of Attorney. Have you ever wondered how to calculate the revenue stamps excise tax on the sale of real estate in North Carolina.

Other North Carolina Excise Taxes. North Carolina Department of Revenue. The North Carolina use tax is a special excise tax assessed on property purchased for use in North Carolina in a jurisdiction where a lower or no sales tax was collected on the purchase.

Seven counties in North Carolina are authorized to impose an. This was subject to change in January and July of each year. How can we make this page better for you.

Prescription Drugs are exempt from the North Carolina sales tax. The NC use tax only applies to certain purchases. 105-22830 provides that the excise stamp tax on conveyances is computed on the consideration or value of the interest or property conveyed exclusive of the value of any lien or encumbrance remaining thereon at the time of sale The deed in question recites that as a portion of the consideration of the.

2005 North Carolina Code - General Statutes Article 8E - Excise Tax on Conveyances. PO Box 25000 Raleigh NC 27640-0640. North Carolina Department of Revenue.

The tax rate is 2 per 1000 of the sales price. PO Box 25000 Raleigh NC 27640-0640. Individual income tax refund.

The tax rate is 2 per 1000 of the sales price. 2022 North Carolina state use tax. Often the tax rate is stepped based on the amount won.

So if you purchase a home or land for 900000 the revenue tax would be 900000 divided by 1000 and multiplied by 2 which equals 1800. 1350 per proof-gallon or 214 per 750ml 80-proof bottle. In accordance with HB 77 s 42 SL.

To calculate the tax multiply the assessed value by the tax rate and divide by 100. Internal Revenue Code 4121 imposes an excise tax on coal from mines located in the United States sold by the producer. Kerosene is generally taxed at 0244 per gallon unless a reduced rate applies.

Effective July 15 1986 the tax rate was changed to 14 cents per gallon plus 3 of the average wholesale price which was then converted to the nearest 110 of a cent.

Excise Tax As A Percentage Of Taxation In Select Countries In 2016 Download Scientific Diagram

Can Pricing Deter Adolescents And Young Adults From Starting To Drink An Analysis Of The Effect Of Alcohol Taxation On Drinking Initiation Among Thai Adolescents And Young Adults Atlantis Press

New Tax On Chemicals In 2022 The Old Superfund Tax Is New Again

Excise Tax As A Percentage Of Taxation In Select Countries In 2016 Download Scientific Diagram

Calculating Excise Tax Help With Closing Statments Youtube

European Union Alcohol Excise Revenues And Duties Download Table

The Effect Of Excise Tax Increases On Cigarette Prices In South Africa Tobacco Control

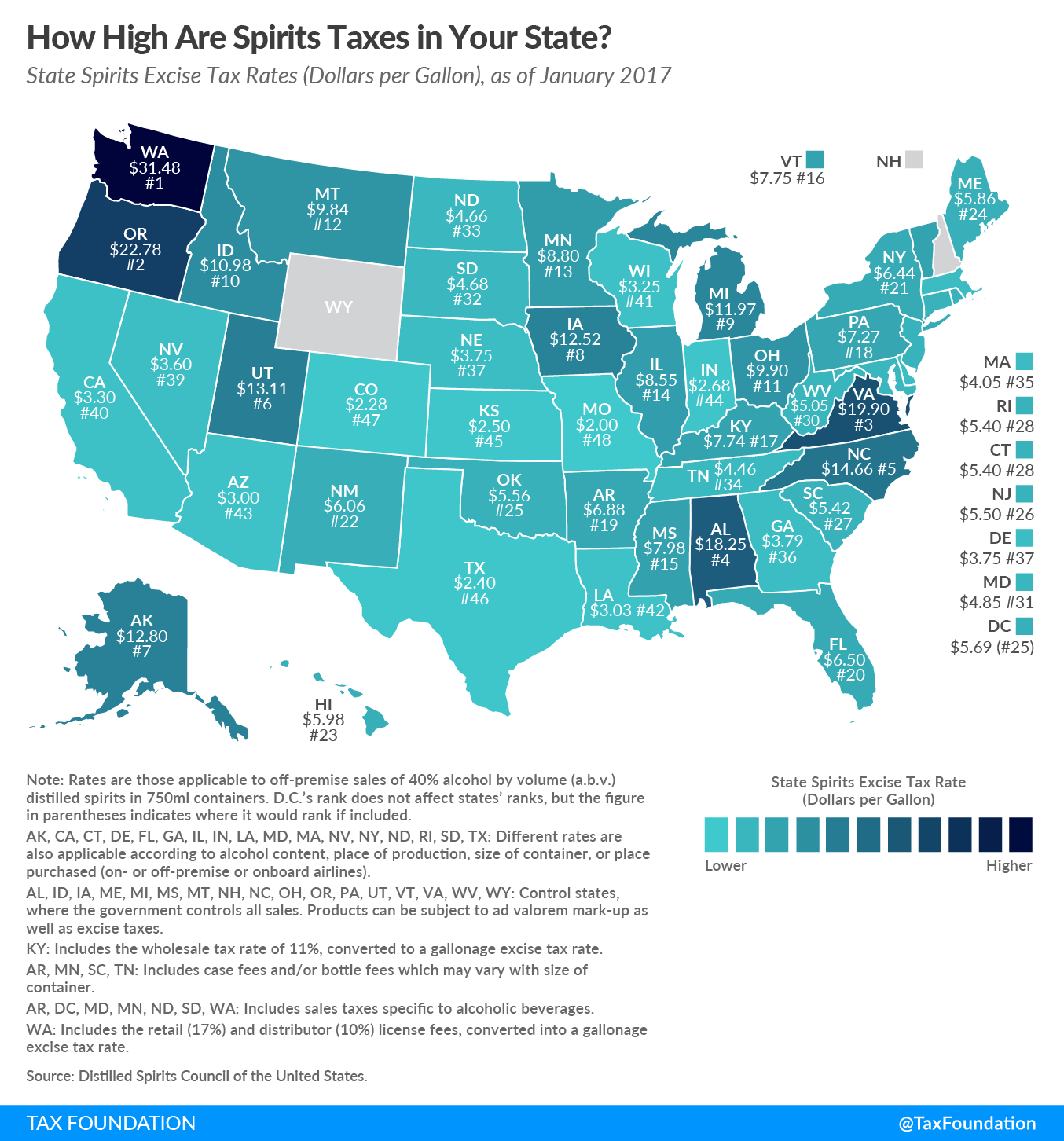

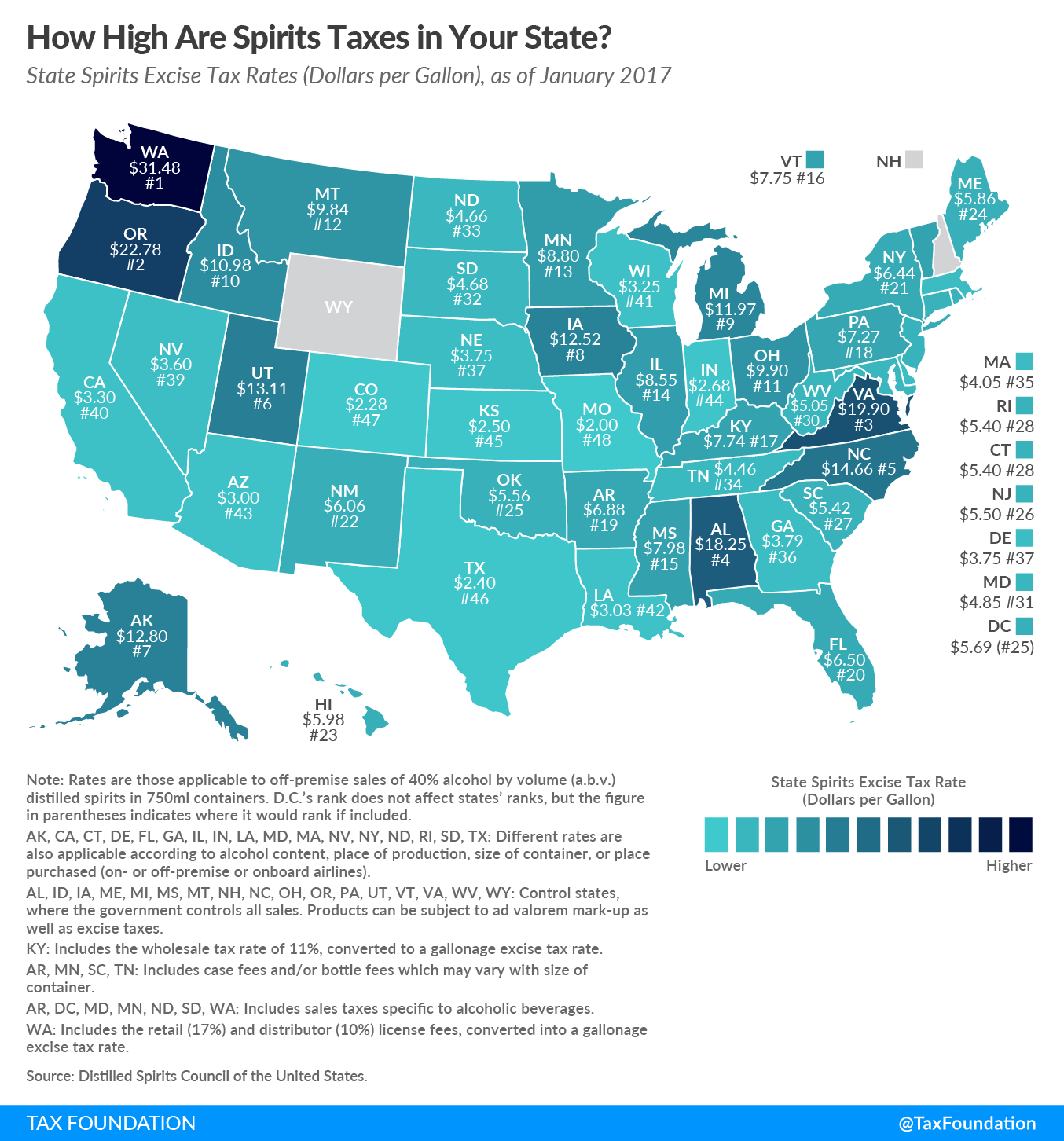

N C Excise Tax On Spirits Nation S Fifth Highest

Cigarettes Hardest Hit By New Excise Taxes Seatca

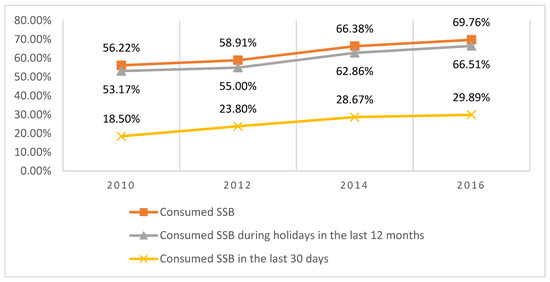

Sustainability Free Full Text Impacts Of Excise Taxation On Non Alcoholic Beverage Consumption In Vietnam Html

Average Real Federal Excise Taxes In Dollars Per Barrel On Alcoholic Download Scientific Diagram

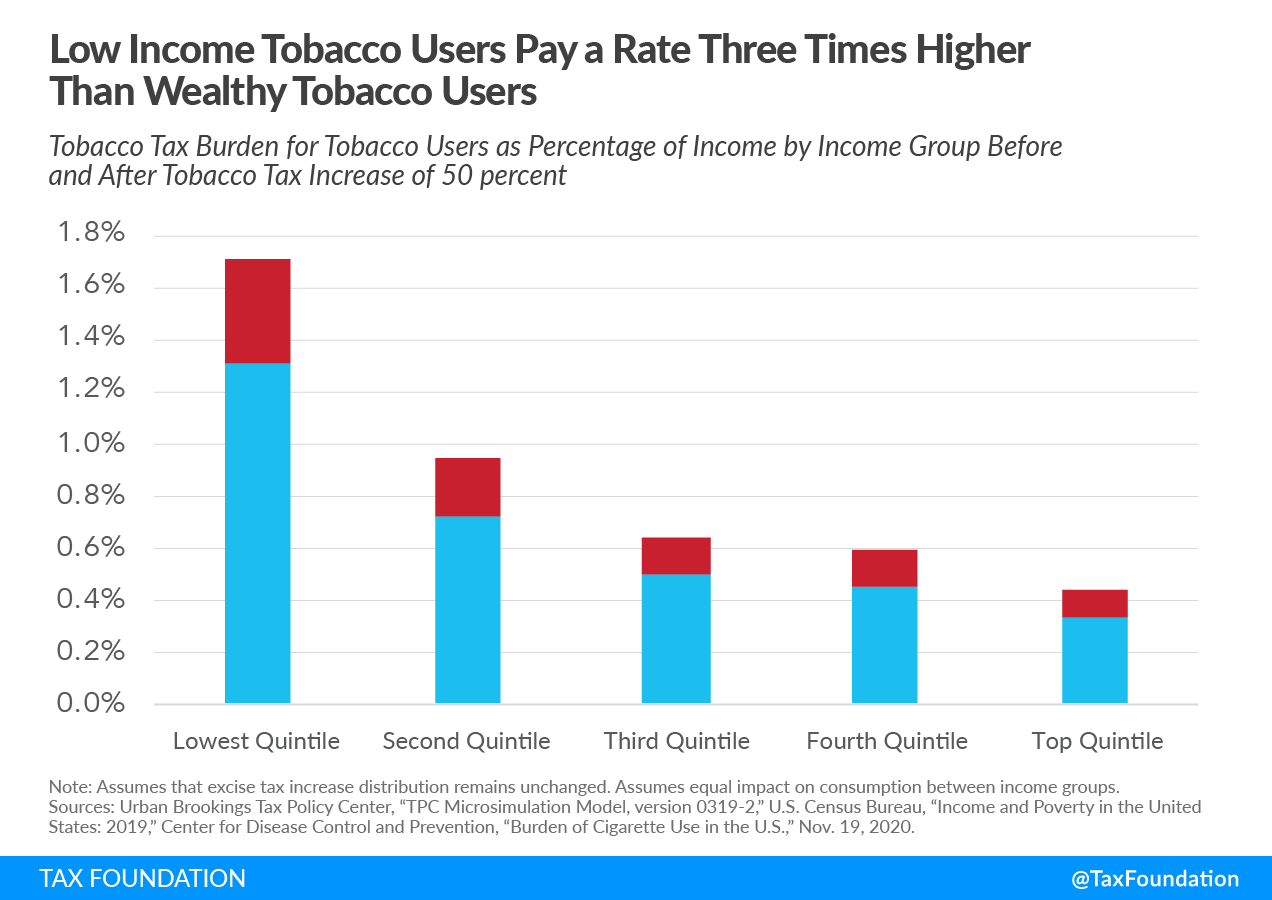

Projected Impact Of Increasing Excise Tax By 50 Per Cigarette Pack Download Scientific Diagram

Calculating Excise Tax Youtube

Punjab Increased Prices Of Cars Bikes Number Plates Number Plate Punjab Car Plates